with Extensive Experience

with Extensive Experience

with Extensive Experience

with Extensive Experience

Aquilo Partners is a life sciences investment bank specializing in mergers and acquisitions, licensing/partnership transactions, and private placements.

On each transaction, we devote a senior team of bankers committed to a transparent, thoughtful approach to success. Our collective life science banking experience includes:

Advising on more than $15 billion in M&A and partnering transactions; raising over $8 billion in capital.

Maintaining top-tier relationships throughout the global life science industry.

Biotechnology, big pharma, specialty pharma, medical devices, research tools and diagnostics.

Our Proven Track Record

Click on one of the images below to view a recent transaction

Select Transactions

Sell Side

Acquisition by Eli Lilly

Sale of preclinical protein therapeutics company

Acquisition by Danaher/IDT

Sale of NGS library preparation genomics kits company

Acquisition by Eli Lilly

Sale of preclinical neuroscience company

Acquisition by Boston Scientific

Sale of a privately held, venture-backed, GI company with strong early commercial traction

Sale of a privately held, venture-backed, GI company with strong early commercial traction

Xlumena’s device portfolio includes the AXIOS™ and HOT AXIOS™ Stent and Delivery Systems. The AXIOS Stent and Delivery System has received U.S. Food and Drug Administration (FDA) clearance and is the world’s first stent designed for endoscopic ultrasound-guided transluminal drainage of symptomatic pancreatic pseudocysts. The next-generation HOT AXIOS™ Stent and Delivery System incorporates cautery into the delivery of the AXIOS stent. Both systems have CE Mark and are currently sold in select countries in Europe.

Boston Scientific Corporation purchased Xlumena for an upfront payment of $62.5m, an additional payment of $12.5m upon FDA approval of the Hot AXIOS product, and further sales-based milestones based on sales achieved through 2018.

Aquilo worked closely with the Xlumena management team and Board of Directors and also provided advice on deal process, valuation and structure. The acquisition enables Boston Scientific, a leader in the EUS market, to advance its product portfolio with Xlumena’s leading interventional EUS therapeutic devices.

Acquisition Completed: April 2015

Location: Mountain View, CA

Team: Greg Patterson (President & CEO), Bill Albright (CFO)

Board of Directors: Greg Patterson (Xlumena), Tony Natale (Prism Venture Partners), Ken Binmoeller (Founder), Barr Dolan (Charter Venture Partners), Ken Hayes, Jason Hong (Third Point LLC), Eric Sillman (Aperture Venture Partners)

Private Placement & Strategic Advisory

Series D Preferred Stock

Financing for commercial-stage best-in-class epilepsy company

Series A Financing Strategic Advisor to Nuvation Bio

Financial advisory services to Nuvation related to the formation and Series A financing

Financing for leading aerosol drug delivery company

Series B Preferred Stock & Debt

Growth capital for private, commercial-stage hip and knee implant company

Growth capital for a private, commercial-stage hip and knee implant company with significant revenues and proprietary robotic and navigation platform

Funding will be used immediately to fund OMNI’s growth initiatives, including expansion of OMNI’s hip and knee product lines; commercial development of the proprietary OMNInav hip replacement solution; and doubling the number of deployed OMNInav systems.

The financing was led by Deerfield Management Company, providing OMNI a strong strategic financial partner with deep experience in the robotics and orthopedic space (previous investment in Mako Surgical), while avoiding syndicate risk.

Aquilo was the exclusive placement agent to OMNI, sourcing the new investor, playing an integral role in determining the structure of the securities, coordinating diligence and negotiating terms.

Closing: April 2014

Security: Convertible Debentures, Term Note, Series B Preferred Stock

Location: East Taunton, MA

Team: George Cipolletti (President & CEO)

Partnering

Global Partnership with AbbVie

Global partnership between AbbVie and HotSpot, a discovery company developing small molecule therapies for cancer and autoimmune diseases, around its IRF5 program.

Partnership with Sanofi

Collaboration to develop and commercialize IRAK4 protein degrader therapies for immune-inflammatory diseases

Partnership with AstraZeneca

Collaboration to develop and commercialize Anticalin-based inhaled treatments for respiratory diseases

Collaboration with AstraZeneca to develop and commercialize Anticalin-based inhaled treatments for respiratory diseases.

Pieris announced a strategic collaboration in respiratory diseases with AstraZeneca to develop novel inhaled drugs that leverage Pieris’ Anticalin® platform, including its lead preclinical drug candidate, PRS-060.

Under the collaboration, Pieris will be responsible for advancing its preclinical lead candidate, PRS-060, into Phase 1 clinical trials in 2017. PRS-060 is an Anticalin against IL-4Ra with potential in asthma. AstraZeneca will fund all clinical development and subsequent commercialization programs and Pieris has the option of co-development and co-commercialization in the US from Phase 2a onwards. In addition, the parties will collaborate to progress four additional novel Anticalins against undisclosed targets for respiratory diseases with Pieris having the option to co-develop and co-commercialize in the US two of these programs.

AstraZeneca will make an upfront and near term milestone payments to Pieris in the amount of $57.5 million — $45 million USD of upfront payments and $12.5 million USD for the initiation of the PRS-060 Phase 1 trial. Pieris has the potential to receive development-dependent milestones and eventual commercial payments for all products not exceeding $2.1 billion as well as tiered royalties on the sales of any potential products commercialized by AstraZeneca. For programs co-developed by Pieris, the Company stands to receive increased royalties or a gross margin share on worldwide sales equal, dependent on the level of investment to which Pieris commits.

Aquilo worked closely with Pieris’ senior management teams in the US and Europe to structure and negotiate the economics and other business-related items of the license and platform agreements.

The collaboration agreement is conditional upon the expiration or early termination of the applicable waiting period (and any extension thereof) under the Hart-Scott-Rodino Antitrust Improvements Act of 1976, as amended.

Acquisition Completed: May 2017

Location: Boston, MA

Team: Stephen Yoder (President and CEO), Louis Matis (SVP and CDO), Lance Thibault (Acting CFO), Claude Knopf (SVP and CBO), Shane Olwill (VP, Head of Development & Immuno-Oncology), Mary Fitzgerald (VP, Respiratory Medicine), Christine Rothe (VP, Head of Discovery & Alliance Management), Eckhard Niemeier (VP, Head of BD), Claus Schalper (VP, Finance)

Board of Directors: Stephen Yoder, Chau Khuong, Michael Richman, Steven Prelack, Jean-Pierre Bizzari, Julian Adams, Christopher Kiritsy

Partnership with Astellas

License and commercialization agreement for WW rights to clinical-stage oncology candidate

Global partnership with Astellas for XTANDI

Medivation was developing enzalutamide, a novel, oral anti-androgen drug candidate for prostate cancer. After a successful Phase 2 trial, Medivation advanced the drug into a pivotal Phase 3 trial in September 2009.

Aquilo assisted Medivation throughout the enzalutamide partnering process, introducing potential strategic partners and helping the company evaluate the financial, strategic and corporate governance aspects of potential partnerships.

The economic aspects of the deal with Astellas include $110 million upfront payment, up to $335 million of development milestones, up to $320 million of commercial milestones, a 50/50 split of US profits, and tiered double-digit royalties on ex-US sales.

When Phase 3 data was released it drove an $800 million increase in market cap for Medivation, and Astellas’ market cap increased by $500 million that same day.

XTANDI (enzalutamide) was approved in the US in August 2012 and commercially available in September 2012.

From the date of the announcement of the global partnership with Astellas until the commercial launch in September 2012, the market cap of Medivation increased by $3.0 billion.

Definitive Agreement: October 2009

Closing: October 2009

Location: San Francisco, CA

Team: David Hung (CEO), Patrick Machado (CFO)

Buy Side

Acquisition of Zoladex in US, CAN from AstraZeneca

Acquisition of marketed cancer therapuetic

TerSera Therapeutics enters agreement with AstraZeneca for Zoladex in the US and Canada.

TerSera Therapeutics entered into an agreement with AstraZeneca for the commercial rights to Zoladex (goserelin acetate implant) in the US and Canada. Zoladex is an injectable luteinising hormone-releasing hormone agonist, used to treat prostate cancer, breast cancer and certain benign gynaecological disorders. It was first approved in the US and Canada in 1989. Zoladex had 2016 product sales of $69 million in the US and Canada and $816 million globally. TerSera will pay AstraZeneca $250 million upon completion. AstraZeneca will also receive sales-related income through milestones totaling up to $70 million, as well as recurring quarterly sales-based payments at mid-teen percent of product sales. AstraZeneca will also manufacture and supply Zoladex to TerSera and will continue to commercialize Zoladex in all markets outside the US and Canada.

Aquilo Partners worked with TerSera to identify and execute the acquisition of Zoladex.

Acquisition of Performance Optics

Purchase of privately held ophthalmic lens manufacturer

Buyside representation on the acquisition of leading global eyeglass lens manufacturing company.

Ophthalmic eyewear lenses is the largest business unit in HOYA’s Life Care segment

The acquisition strengthens HOYA’s ability to provide customers with a broader portfolio of leading products, while continuing to provide best-in-class services to the eyewear industry.

Aquilo coordinated with the senior HOYA management team and legal and accounting advisors to structure and negotiate the transaction, provided financial analysis support, and helped manage cross-border diligence and the deal process.

Aquilo worked closely with HOYA leadership in Asia, Europe and the US.

Acquisition Completed: August 2017

Closing: August 2017

Location: Tokyo, Japan

Team: Hiroshi Suzuki (President & CEO), Ryo Hirooka (CFO), Girts Cimermans (Vision Care Company President), Augustine Yee (Chief Legal Officer and Head of Corporate Development and Affairs)

Partnership with Curetech

In-license of clinical stage immunotherapy

Buyside representation on the in-licensing of late stage cancer program

Buyside representation of Medivation on the in-licensing of an anti-PD-1 immune modulatory monoclonal antibody from CureTech Ltd. for potential applications in oncology for up to $335 million in upfront and milestone payments. Aquilo worked closely with the senior management of Medivation providing valuation and structure advisory.

The in-licensing of this program allows Medivation to diversify its cancer portfolio while also increasing its presence in immuno-oncology.

Acquisition Completed: December 2014

Location: San Francisco, CA

Team: David Hung (CEO), Rick Bierly (CFO), Lynn Seely (CMO)

Purchase of SPL

Acquisition of privately held manufacturer and supplier of heparin

Shenzhen Hepalink Pharmaceutical Co., Ltd.

Buy-side representation of Hepalink in the acquisition of privately held Scientific Protein Laboratories, LLC (“SPL”) for US$337.5 million in cash plus certain contingent payments.

Aquilo worked closely with Hepalink’s US-based business development subsidiary and with the company’s senior leadership in China, providing valuation and structure advisory, as well as cross border diligence and deal process coordination.

The acquisition of SPL allows Hepalink to expand its presence as a leading worldwide supplier of heparin, and provides the combined company with greater product development and growth opportunities in new markets.

Acquisition Completed: April 2014

Location: Shenzhen, China

Team: Li Li (Chairman & CEO), Haihua Bu, Bruce Wendel, Gary Doten

Office Locations

San Francisco

601 California Street, 5th Floor

San Francisco, CA 94108

(415) 677-9773

info@aquilopartners.com

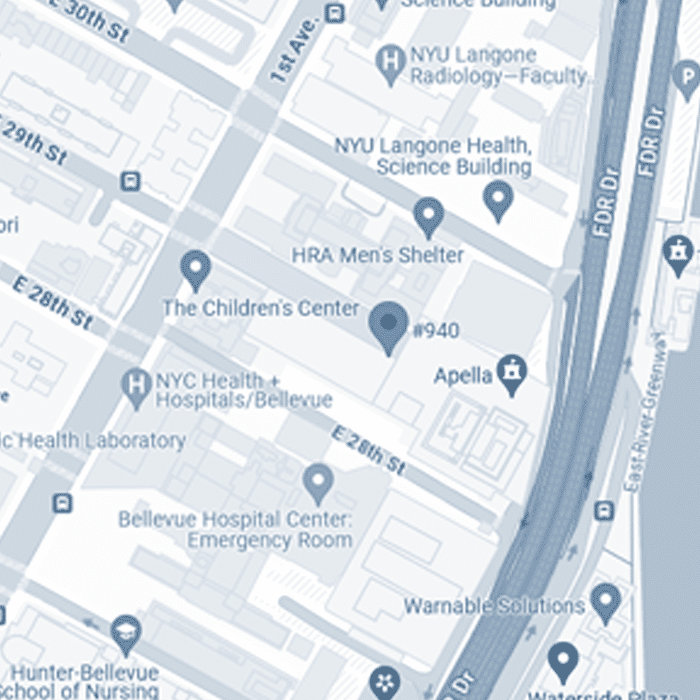

New York

430 East 29th Street, Suite 940

New York, NY 10016

(415) 505-2748

info@aquilopartners.com

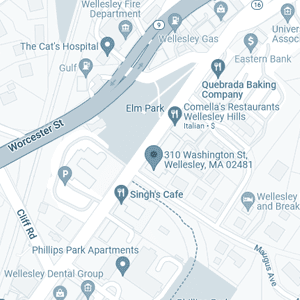

Boston

310 Washington St, Ste 201

Wellesley, MA 02481

(617) 401-2483

info@aquilopartners.com